change in net operating working capital formula

The formula for the Change in Net Working Capital subtracts the current period NWC balance from the prior period NWC balance. Net Working Capital Current Assets less cash Current Liabilities less debt.

Change In Net Working Capital Nwc Formula And Calculator

Given those figures we can calculate the net working capital NWC for Year 0 as 15mm.

. Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Or. Change in working capital is a cash flow item that reflects the actual cash used to operate the business. Operating represents assets or liabilities which are used in the day-to-day operations of the business or if they are not interest-bearing financial.

Since companies often purchase inventory on credit a related concept is net operating cycle or cash conversion cycle which factors in credit purchases. Owner Earnings 8903 14577 5129 13312 2223 13084. Net working capital also includes net operating working capital which is the difference between a companys current operating assets and operating liabilities.

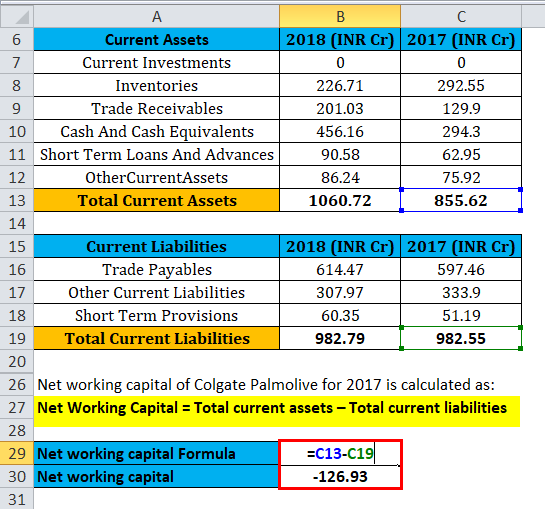

The formula for calculating net operating working capital is. Cash Accounts Receivable Inventory Accounts Payable Accrued Expenses. Net working capital 106072 98279.

Ultimately this ratio shows how well a company is able to use its current operating assets and how able it is to make changes to accommodate both new opportunities and unforeseen events. Net Working Capital Formula Current Assets Current Liabilities. Cash and other financial assets are typically excluded from operating current assets and debt.

Net change in Working Capital 1033 850 183. The formula for the Change in Net Working Capital subtracts the current period NWC balance from the prior period NWC balance. Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm.

As per the above table the Net Working Capital of Jack and Co Pvt. Cash Flow is the net amount of cash and cash-equivalents being transferred in and out of a company. Based on the above calculation the Net working capital of Colgate Palmolive India is positive which indicates that the short-term liquidity position of the company is positive.

In this case the change is positive or the current working capital is more than the last year. Similarly change in net working capital helps us to understand the cash flow position of the company. This metric is much more tied to cash flows than the net working capital calculation is because NWC includes all current assets and current liabilities.

What Is Change In Working Capital Formula. Net working capital is calculated using line items from a businesss balance sheet. Net Working Capital Total Current Assets Total Current Liabilities.

Net operating working capital is a financial metric that gauges the difference between a companys non-interest bearing operating assets and its non-interest charging. Below is a short video explaining how the operating activities of a business impact the working capital accounts which are then used to determine a companys NWC. Working Capital Current Assets Current Liabilities.

Generally the larger your net working capital balance is the more likely it is that your company can cover its current obligations. The value of your current assets has changed. The net operating working capital formula is calculated by subtracting working liabilities from working assets like this.

Operating working capital is defined as operating current assets less operating current liabilities. The last step is to determine the change in working capital by using the formula. 240000 2022 105000 2021 135000.

As for the rest of the forecast well be using the. Positive cash flow indicates that a companys liquid assets are increasing. A change in net working capital equals an increase in net working capital.

Change in a Net Working Capital Change in Current Assets Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year. Net Working Capital Current Assets Current Liabilities 49433M 43625M 5808 million. If a company stock piles a ton of cash you can treat some of it as excess cash and tack it back on after youve completed the entire DCF valuation.

You include change in cash as a part of change in overall working capital. Often called the changes in working capital section of the cash flow statement commingles both current and long-term operating assets and liabilities. For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it was for Amazon and Microsoft.

Subtract the previous years working capital from the current years working capital according to the calculations made above in the table. Inventory cash cash equivalents marketable securities accounts receivable and so on are all components of the financial system. So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash.

So a positive change in net working capital is cash outflow. Changes in net working capital impact cash flow in financial modeling. For year 2020 the net working capital is 10000 20000 Less 10000.

Business accountants calculate net and net operating working capital the same way where the NWC current assets - accounts payable - expenses. Ad HSBC Has a Range Of Solutions To Help You Self. For the year 2019 the net working capital was 7000 15000 Less 8000.

Because of this NOWC is often used to calculate free cash flow. It comprises inventory cash. It still counts as cash that is tied into running the day to day operations of the business.

Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Change in a Net Working Capital Change in Current Assets Change in Current Liabilities. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling and managing cash flow. Now changes in net working capital are 3000 10000 Less 7000.

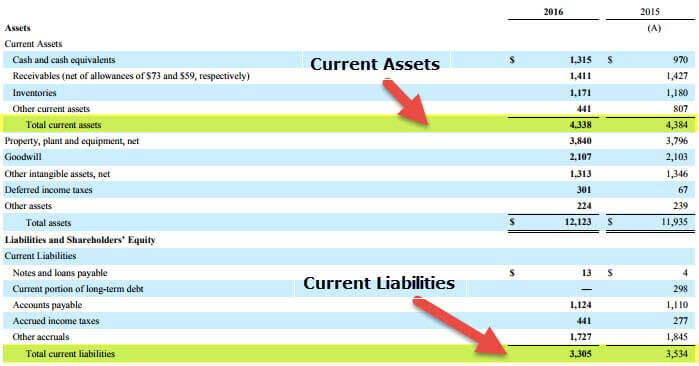

Net Operating Working Capital Operating Current Assets Operating Current Liabilities 30678M 34444M -3766 million. The wrong way to do this is to calculate the working capital in year one from the balance sheet then calculate the working capital in year two from the balance sheet and then subtract to get the change. Net Working Capital NWC 75mm 60mm 15mm.

The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Net working capital 7793 Cr. Current Operating Assets 50mm AR 25mm Inventory 75mm.

Cash on hand varies for different companies but having. Low working capital and low net operating working capital together with unfavorable current ratio quick ratio days sales in receivable and. Cash and Cash Equivalents Trade Accounts Receivable Inventories Debtors Creditors Short-Term Loans 135000 55000.

So the change in NWC is 135000. Changes in working capital -2223.

What Is Net Working Capital How To Calculate Nwc Formula

Working Capital What It Is And How To Calculate It Efficy

Days Working Capital Definition Formula How To Calculate

Change In Working Capital Video Tutorial W Excel Download

Net Working Capital Template Download Free Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Net Operating Working Capital What It Is And How To Calculate It

Net Working Capital Formula Calculator Excel Template

Net Working Capital Meaning Examples Formula Importance Change Impact

Change In Net Working Capital Nwc Formula And Calculator

Net Working Capital Definition Formula How To Calculate

Net Working Capital Formula Calculator Excel Template

Changes In Net Working Capital All You Need To Know

Working Capital Formula And Calculation Exercise Excel Template

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)